10 Things You Learned In Preschool That'll Help You With Lending Solutions

It's never been extra crucial to reevaluate at your digital method. We can aid you grow your connections to customers and services with instinctive services that set you aside from the competitors todayand in the future.

You can find more information about the topic here: sandstone.com.au/en-au/lara

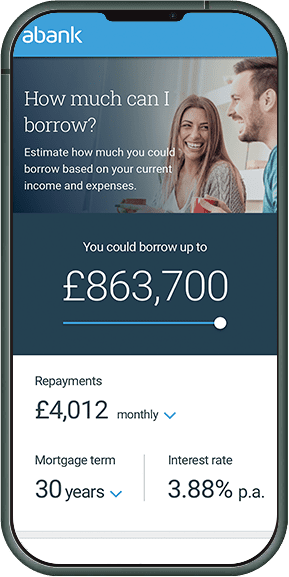

Mobile financial modern technology puts your bank in the palms of your clients' handsno matter where they are. Sandstone's mobile banking system offers ease as well as 24/7 accessibility that constructs significant connections with your retail and also business customersall on their preferred mobile tools. Integrated with Sandstone's core financial system, our mobile financial app offers your financial institution accessibility to a personalized, straightforward collection of functions.

With Sandstone's company financial app, your bank is empowered to broaden your business profile by providing little company proprietors the capacity to take their banking with them. Our organization financial app brings business capability to our currently stacked mobile application with: Mobile approvals to manage ACH, cables and tax obligation payments Full wire production and also editing Full Positive Pay capability Ability to manage the entitlements and also permissions of sub-users as well as monitoring of company information Multi-check down payment Your clients expect 24/7 accessibility to your bank.

Our Electronic banking options provide interactive, industry-leading solutions that make electronic banking a breeze for you and your consumers, and allow you to construct and preserve a solid digital presence. Sandstone's on the internet financial services drive earnings via a fully integrated set of devices created to enhance exactly how your retail and company consumers communicate with their financial resources and your bank online.

Encourage them to achieve life's landmarks with Sandstone's individual economic management (PFM) software. Integrated with Sandstone's mobile financial app and online financial options, our PFM software program encourages accountable costs and also saving routines by picturing as well as arranging your consumers' economic information, permitting them to: Boost economic actions by establishing as well as taking care of budgets Track their expenses and also objective development Envision their monetary health and wellness at any kind of given time Automate personal alerts to manage spending beyond your means Sandstone's mobile banking app and electronic banking system offer one of the most relevant, up-to-date electronic financial technology that profits your bank with: Enhanced customer loyalty and account retention Boosted market share, mobile adoption and transaction quantity Instantaneous customer accessibility through self-registration choices Raised income generation using advertising and marketing projects.

Change generic transactions and also inquiries into customized as well as intelligent experiences. Use chat robots to solve cases much faster across any type of channel, link complicated solution concerns back to speak to facility representatives equipped with an omni-channel work area, as well as provide proactive recommendations to consumers with journeys based upon their goals.

By 2021, three billion people worldwide will be banking via digital systems. Accountholders significantly anticipate an experience that matches their electronic way of life. To provide this, financial institutions as well as cooperative credit union need to provide a highly that corresponds across channels. With sophisticated digitalized procedures, banks can achieve an and also increase to 37% even more yearly profits from customers that are totally engaged.

Finastra's retail digital services help you via the channels of your choice phone, tablet, desktop or wearable. Our electronic options permit monetary establishments to prolong services to and with 3rd parties as well as integrate with Finastra or other core systems. For your customer and also organization accountholders, this means having cutting-edge electronic solutions that matches their lifestyle as well as enables them to bank the method they desire with a * Source McKinsey ** Forrester Technology fostering profile: Flexible Digital Financial For A Dexterous Future -October 2016.

The battle between challengers as well as incumbents hots up every month and IBS Journal is right here to assist you understand the field of battle. In this unique, digitally-themed Attribute Focus, we examine what it is that makes the challengers so disruptive and just how the tradition banks can respond. Opposition financial institutions are right here to "conserve the day" from "puffed up" incumbents who have "taken their consumers for approved" for method to long.

That a minimum of, is the narrative being pushed by the new kid in towns. What's the reality though? We take a look right into simply exactly how as well as why the oppositions have actually made their effect, and examine whether they really can the huge kids. For lots of decades, financial institutions have actually looked relentlessly for ways to satisfy that many evasive desire of the client: convenience.

With the development of the smartphone, nonetheless, that march has actually come to be a lung-busting sprint. While mobile financial adoption remains to grow continuously throughout markets like Europe and the United States, it has actually exploded into life in Africa as well as Asia. What's behind this difference, and also will we see a similar blaze in 2017? M-Pesa may be thriving, however can it scrub shoulders with the sort of Apple and Alphabet? IBS Journal checks out.

Each concern of our front runner monthly consists of a, devoted to a specific area of financial innovation. The Feature Foci become part of the IBS Journal registration. IBS Journal Feature Foci cover a large range of topics relevant to the financial technology industry worldwide. They consist of thorough case research studies, analysis, interviews and other attribute posts.

All articles are composed by IBS, and also our team believe that this dedication to high quality is one-of-a-kind amongst publications in the banking/financial services innovation room.

Digital financial belongs to the broader context for the relocate to online financial, where financial services are delivered online. The change from typical to digital banking has actually been progressive and stays recurring, and is made up by varying degrees of financial service digitization. Digital financial entails high levels of process automation as well as web-based solutions and may include APIs allowing cross-institutional solution make-up to supply financial items as well as offer transactions.

An electronic bank represents a virtual procedure that consists of electronic banking and past. As an end-to-end platform, digital banking should include the front end that customers see, the backside that lenders translucent their servers and also admin control board and the middleware that links these nodes. Eventually, a digital financial institution should facilitate all useful levels of banking on all solution shipment platforms.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA